Are you constantly expecting returns with your investments but never see any? Everyone wants to make a buck in the stock market, but few really know what attributes help to create a successful trader. Read through this article so you can gather tips about making the most money possible.

Be sure you invest over an array of different areas. If you only invest in one company and it loses value or goes bankrupt, then you have just lost your entire investment and your loss is total.

If you want the comfort of a full service broker but also wish to make your own picks too, you should find a broker that will offer both full services and online options. This way you’ll be able to dedicate part of your stocks to a professional manager and still handle part of it yourself. This allows you to have the safety net of a professional and complete control over your goals.

Investment Decisions

Know what your areas of competence and stay somewhat within them. If you make your own investment decisions, only consider companies that you understand well. You may be knowledgeable about a landlord management company you once rented from, but what do you know about a business in a field with which you are completely unfamiliar? Leave investment decisions like these to a professional advisor.

The strategies in your plan should include strategies about when you will buy and when to sell. You should also include a definite budget regarding your investments. This will ensure that your choices with your head and not your emotions.

Keep your plan simple if you’re just starting out. It can be fun and exciting to pick a buffet platter of stocks but as a beginner, but you should choose one method and stick with it if it works for you. This ends up saving you cash in the long term.

Steer clear of stock market advice and recommendations that are unsolicited. Of course, your own adviser should be listened to, especially if the investments they recommend can be found in their own personal portfolios. No substitute exists for researching on your own, and those being paid to peddle stock advice certainly don’t.

A lot of people are under the impression they can get wealthy off purchasing penny stocks, but they don’t look at the money making potential of highly rated blue-chip stocks.It is always a good idea to pick stocks that will grow in the future, as well as newer companies who have potential to have explosive growth.

Don’t rule out other beneficial investment opportunities to make profitable investments. You can make profits with mutual funds, bonds, real estate and even art.

Be open minded when it comes to stock prices. One rule of math that you can’t avoid is that the higher priced an asset is, compared to how much you are earning.A stock that seems overvalued at $50 a share may look like a killer deal once it drops to $30 per share.

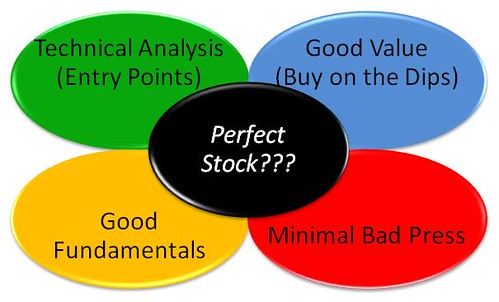

When you delve into the stock market, find a method that works well for you, and stick with this strategy. Maybe you are seeking companies that have high profit margins, or perhaps you are looking for companies with lots of handy cash? Everyone has different strategies when they invest, and it is important that you select the strategy that works for you.

Start investing career with larger companies that have more profitable options. If you are a novice trader, start with a portfolio consisting of well-known companies, as these normally have a lower risk involved. Smaller companies may grow quickly, but they’re very high risk.

Follow the dividends of companies where you purchase stock. This is really true for an established investor who wants to have stability with their returns. Companies with large profits typically reinvest it back into their business or pay money out to shareholders through dividends. It is important that the yield of a dividend’s yield.

Review your stock portfolio constantly. Don’t take this too far, however; remember that stocks are often very volatile, and checking too often could just raise your anxiety level.

Consider using the services of a investment broker.Stockbrokers will have inside information, but nothing illegal, and you can use this information to make wise investment decisions.

Attending a stock investment seminar about investing can help you get an idea of where to invest your money into different stocks.

It can be volatile at times to invest, since the market is very volatile.

Start by investing in the stock with a little bit of money. Do not put everything you have into one stock. If you find that the investment proves to be a sound one, then you can branch out and invest some more. If you invest too much initially, there is a good chance of losing a large amount of money.

As you’ve learned in this article, there are many techniques for making smart investments. Put this advice into practice in your own investments and build a portfolio to be proud of. Stand out by becoming a high earner.