There are other principles beyond just buying low and hoping to sell high strategy. Read this article so that you can make the most money possible from stock market trading.

Keeping things simple can really be effective in life, and the stock market is no exception.

Watch the stock market closely before beginning to invest. Before your initial investment, you can avoid some of the common beginner mistakes by watching the market for a while. The best way is to monitor it for about three years before investing. This will give you a view of how the market operates and increase your chances of making wise investments.

Exercise your shareholder voting rights granted to you as a holder of common stock. Voting is normally done at a yearly meeting held for shareholders or by mail through proxy voting.

When your aim is to build a portfolio that maximizes long-range yields, include the best stocks from various industries. Even while the whole market grows on average, not at all industries are constantly and simultaneously in expansion. By exposing yourself to diversification, you can capitalize on the growth of hot industries to grow your overall portfolio.

Full Service

If you want to have the full service of a broker but also make your own choices as well, then you should work with brokers who can provide you online and full service options. This way you’ll be able to dedicate part of it to a professional manager and still handle part of the rest on your own.This can give you both worlds in your investing.

The plan should be about when to buy and when you will sell. It must also entail a precise budget for your investment limitations. This practice will allow you to make your decisions are based more on logic than on emotions.

Keep your investment strategy simple and small when you are first starting out. It can be tempting to diversify right away and try everything you have read about or learned, but if you’re new in investing it is good to focus on one thing that truly works and stick to it. This will save you cash in the end.

Don’t rule out other opportunities to make profitable investments. You can find many other promising investments, art, real estate, and bonds.

Remember that cash does not always profit. Cash flow is essential to any financial operation, and that also includes your investment portfolio. It is a good idea to invest your earnings, but make sure you have enough money to pay your bills. Make sure you keep an emergency fund of living expenses somewhere liquid and safe.

Most middle-class wage earners qualify to open this opportunity. This investment method comes with so many tax breaks and other rewards that you can yield large returns over time.

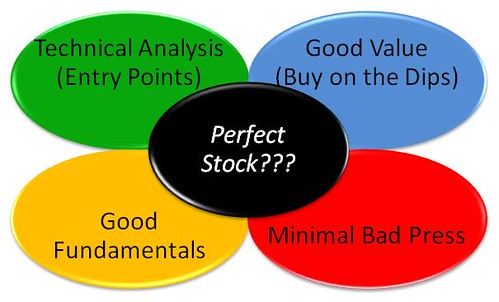

Using a constrain strategy is often a good idea.This means you choose stocks that are not very popular. Look into companies that are being traded below their value. The stocks that are attracting lots of investor wants to get in on typically sell at an inflated by the attention. That can leave you with no upside. If you find small companies with positive earnings, it is possible to get some really great deals.

Consider hiring a stock broker. Stockbrokers usually have useful information about stocks, stocks and bonds, and you can use this information to make wise investment decisions.

Sometimes, corporate management teams hold only five percent of your stock, but somehow control 70% of the voting power. This should be a red flag.

Before purchasing any type of stock, think about what your long-term plans are. You could be seeking a low-risk opportunity to generate some income, or you could be thinking about expanding your portfolio. Knowing what your goal will help you the best chance of success.

Be sure that you’re eye is always on trade volume. Trading volume indicates investor interest in identifying how a stock and the number of people who are buying and selling it. You must know how active a company trades to figure out if you should invest.

Start investing by putting in just a tiny amount in one particular stock. Do not put all of your savings or capital. If you find that the stock starts bringing in a profit, then you can begin to invest more. By investing too much all at once, you lose large amounts of cash.

A good portfolio can offer up to an 8 percent return on your investment, but a great portfolio will bring you 15 to 20 percent interest. Choosing investments is not simple by any means, but over time, your efforts will pay off in the form of a profitable portfolio.

If a company that you have invested in performs surprisingly well, there’s a good chance it will happen again. This also applies for a negative outcomes. Always make sure to keep these possible experiences in mind when deciding on what businesses to invest in.

Research every company you are interested in investing in. Learn their profit margins,their purchasing power, reputation, as well as their past performance – so you can make an informed decision. Do not put your faith in gossip, make sure you keep your information updated. Keep in mind the above tips in order to generate the largest amount of profits that you can from your investments.