Have you ever had the desire to be a part owner in a business? If you answered yes, then investing in the stock market is perfect for you. Before you rush out and invest your life savings in stock, learn as much as you can about how to invest wisely. The piece that follows offers the tips in this article can help you do just that.

You will also be more successful if you have realistic expectations, this way you know what to expect and aren’t surprised. Hold stocks as long it takes to meet your profit goals.

Stocks are more than slips of paper that is bought and sold. When you own stocks, you become a member of the collective ownership of that specific company you invested in. This entitles you a claim to assets and claims on assets. You can often make your voice heard by voting in elections for the companies corporate leadership.

If you want to build a solid portfolio that delivers good yields over the long term, you want to include strong stocks from various industries. Even as the overall market grows, not at all industries are constantly and simultaneously in expansion. By having positions across multiple sectors, you will allow yourself to see growth in strong industries while also being able to sit things out and wait with the industries that are not as strong.

A stock that yields two percent but has twelve percent earnings growth is significantly better than the dividend yield suggests.

Discount Brokerage

Know the limits of your knowledge and stay within that. If you are using an online or discount brokerage yourself, use a discount brokerage and look to invest in companies that you are knowledgeable on. You may have excellent insight about a landlord business’s future, but what do you know about a business in a field with which you are completely unfamiliar? Leave investment decisions to a professional advisor.

Do not let investing in stocks make you blind to other opportunities. There are other great places to invest, such as bonds, bonds, real estate and art.

Be open minded if you’re considering stock at a particular price. One definite rule of math that you cannot ignore is that your return is lower depending on how much more you put into an asset, the less amount you will get in return. A given stock that is expensive today might be affordable next week.

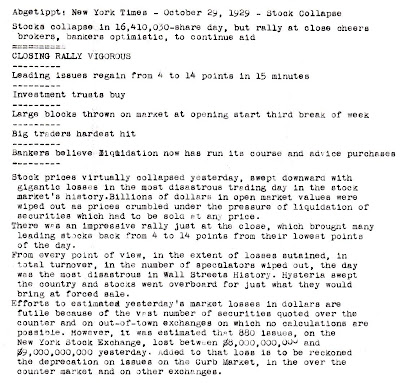

Stock Trading

Online stock trading in stocks can be a great way to save some money while saving money. Internet stock trading firms are often significantly less expensive than other brokerage firms. Look online for the best deals and reviews. TradeKing or Fidelity are two great choices.

Attending a seminar can help you get an idea of where to invest your money into different stocks.

The stock market is extremely volatile at times, and many traders who get into it solely to make sort-term gains wind up losing a lot of money.

Start by putting a tiny amount in one particular stock. Do not invest all of your savings or savings. If the stock is rising in value, then you can begin to invest more. By investing a little at a time, you lose large amounts of cash.

This is just as important as remembering your buying and selling when investing in stock. This means that it can make it difficult to sell stock when you want to.

Many an investor has found that too much greed worsens their position in the stock market rather then improving it. This has been proven time after time to be a quick way that many people end up losing substantial amounts of money in the market.

You will want to educate yourself about accounting and money management principles before jumping into the stock market. You don’t need a formal education, but a class or two on the basics can prove very useful.

If you experience a positive surprise from a business, this can be a good sign for the future. This also holds true for a negative surprise. Always keep these possible experiences in mind when you are deciding on what businesses to invest in.

Consider the value of a stock, too.Is this stock that will need a while? If the price is lower than normal, do your homework prior to purchase, to make sure that it’s actually a worthwhile investment. Don’t just buy a cheap stock in the hopes that you will make money off of it.

Don’t think of the stock market as a quick buck opportunity. You will need to spend time learning about trading before you are destined to fail. You must take some time to make a few mistakes, as well as to learn from them.

When you are planning out the diversification of your portfolio,diversify your holdings and remember that a slew of factors lead to diversification; it isn’t simply about buying from different sectors.

Invest in sectors that you are familiar with. Peter Lynch said the reason that he did not invest in electronic stocks because he did not understand them. Instead, this man invested in consumer staples, underwear, pantyhose and underwear comapnies. The lesson here is to deal mainly with those things that you understand well.

Stock Market

Now that you’ve read over this article, do you find stock market investing to be interesting to you? If it does you should get ready to take some initiative and get into the market. Keep the basic information in mind and you will soon be playing in the stock market, without losing alot of money.