Are you constantly looking for strong returns on your stock investments that never seems to come through? Everyone wants to succeed in the stock market, yet few know how to truly become successful. Read this article so you can to boost your earnings.

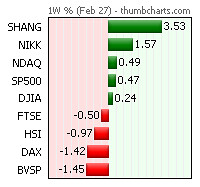

Watch the stock market closely before beginning to invest. Before your initial investment, you want to watch the market for awhile. The best advise is to watch the upswings and downswings for a period of three years or so. This will give you a much better idea of how the market operates and increase your chances of making wise investments.

Before you do anything that involves investing with a broker or trader, find out the fees you must pay. You need to know the cost of both the entry and deduction fees.The fees surmount quickly and can add up to a significant portion of your profit.

Exercise the voting rights if you have common stocks. Voting is normally done at a yearly meeting held for shareholders or through the mail by proxy voting.

This will help you to choose your options when it comes to investing.

Know what your areas of competence and skills and stay within that. If you are going to invest without help or using a online broker, be sure you are looking only at companies you are familiar with. You may be knowledgeable about a landlord management company you once rented from, but do you understand anything about a company that makes oil rigs? Leave investment decisions to a professional.

Keep your investment strategy simple when you are just starting out. It can be fun and exciting to pick a buffet platter of stocks but as a beginner, but you should choose one method and stick with it if it works for you.This will end up saving you a whole lot of money in the end.

Damaged stocks can work, damaged companies are not. A bump in the road for a stock is a great time to buy, but be certain that it’s merely a temporary dip. When company’s miss key deadlines or make errors, you know its the perfect time to invest.

If you are going to use a brokerage firm when investing in a market, make sure they’re trustworthy. There are lots of firms who promise to make you tons of money investing in stocks; however, yet they are not properly skilled or educated. The Internet is a great place to find out about different firms and their success rates would be to check out online reviews.

When investing in the market, you should find a profitable strategy and stick with it.Maybe you aim to find businesses that always have high profits, or perhaps you maybe focusing on companies with a lot of cash at hand. Everyone has a different strategy when it comes to investing, so it’s important you pick the best strategy for you.

Think about investing in a stock purchases. If the stock’s value rises, think of the dividend as an added bonus. They may also a good source of periodic source of income.

Most middle-class citizens qualify for this type of account. This kind of investment strategy offers many tax breaks and other rewards that you can yield substantial income of a number of years.

Sometimes, a corporate management team will only hold 5% of the stock, but the voting power control can be around 70%. Situations like this are a strong warning signs not to buy these stocks.

Attending a stock investment seminar about investing can help you learn to make better investment decisions.

Start by investing in the stock with a little bit of money. Do not start out by investing all of your money into investments. If you find that the stock starts bringing in a profit, invest a little more money. If you try to to invest too much when you do not know what you are doing, you increase the chance of losing more money.

Learn how to assess risk. There is always some risk when investing. Bonds often have less risk than mutual funds then stocks. There is no such thing as a risk with every investment. You must learn how to spot risky investments so you can make sound investment decisions.

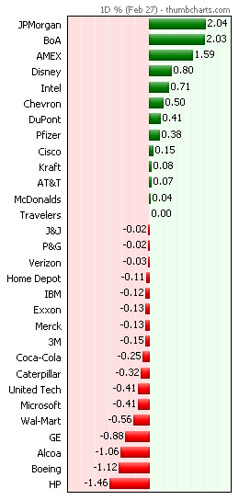

Projected Return

When you analyze stocks, look at the stock’s projected return in conjunction with their earnings ratio. The price/earnings ratio needs to be less than two times the total projected return is. If you want to invest in a stock that has a projected return of 10%, then you should be looking at a earnings to price ratio of roughly 20.

Make sure you are comfortable with the stocks or mutual funds you invest in them. You need to know what sort of risk you are able to tolerate as an investor. If losing money will make you anxious or upset, stick with mutual funds and conservative stocks, or consider keeping your money in cash vehicles. If you’re okay with a little risk, you are probably well suited for more speculative stocks which involve more unpredictability.

Many people forget that undue greed works against them when dealing with stock market rather then improving it. This is one way many people end up losing substantial amounts of money.

Now that you have read these tips, you should be able to start investing wisely right away. Change your strategy as necessary so you can build a portfolio to brag about! Earn more from your investments and make yourself stand out.